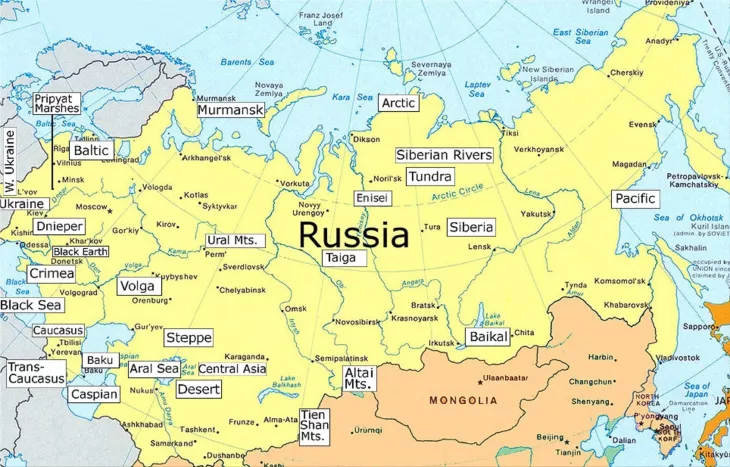

Russian investors are skeptical of Washington's dire warnings of impending conflict. On Monday, global equities fell, and safe-haven government bonds climbed as the US warned Moscow that it might attack Ukraine at any time. While Russian assets have slid, they have not yet factored in the most severe economic penalties.

American concerns that an assault may occur within days sent headlines about Russia's army buildup along the Ukrainian border to the top of financial news websites. The danger of conflict with its neighbor, on the other hand, received far less attention in the Russian media. This demonstrates the chasm between western warnings and the Kremlin's rhetoric, consistently denying plotting an invasion.

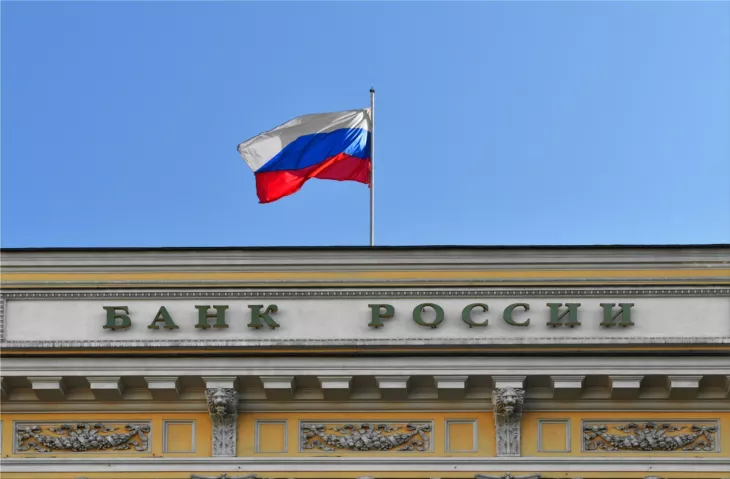

The split is reflected in the markets. While speculators raced into the dollar and yen, Russian assets are not pricing in worst-case scenarios. Consider Sberbank, whose shares fell 5% on Monday. Russia's largest lender has lost some of its gains from last year but is still valued at over one times book value, according to Refinitiv data, up from about 0.8 times in 2014, following Russia's annexation of Crimea. If the United States and Europe put sanctions on Russian banks, many foreign investors, who owned around 43% of Sberbank as of the most recent filing, will almost certainly be forced to sell. The MOEX index, denominated in roubles, fell approximately 3% on Monday but remains above its late January lows.

Additionally, the rouble is proven impervious to rumors of conflict. To be sure, President Vladimir Putin has protected Russia's economy from western reprisal, and the central bank's rate boost last week aided in stabilizing the ruble. However, investors are not factoring in a recession on the scale of the one sparked by sanctions in 2014, when the rouble lost nearly half its value against the dollar. As a result, yields on 10-year Russian government bonds increased above 10% on Monday but remained much below the 16 percent-plus levels seen in late 2014.

Even if Russia invades, fears about suffocating Europe's gas supply may sway the US away from the most severe penalties. However, western governments have many additional means of doing economic harm. So if the conflict is indeed coming, investors are in for a lot more misery. #@ Reuters and Gerane.